You aspire to initiate the task promptly and with minimal exertion.

I understand. I have been in that situation.

Do not fret; This article will outline how to begin using Bitcoin in five easy steps and how to put money into Bitcoin.

In this article, I will discuss the following topics:

- Where to acquire Bitcoin.

- Utilizing the top choice to purchase cryptocurrency.

- Safeguarding your Bitcoin investment.

- The ideal setup for Bitcoin investors.

- Discovering chances beyond just investing in Bitcoin.

Furthermore, there are many other questions to cover.

So, let’s commence!

#0. Four Facts Regarding Bitcoin That Must Be Understood

It is necessary to be knowledgeable about certain risks before you learn how to earn from Bitcoin.

You can go straight to step one if you are already aware enough and don’t want to read about them.

It is possible to gain a substantial profit from investing in Bitcoin. However, it can also be a risky endeavor.

Let’s look at the reasoning behind it.

1) Bitcoin has not yet matured as an asset class

It might be surprising to some, but the current form of the stock market might not have existed if not for certain circumstances.

For a long time, stocks have been an available investment option. You may have set up a retirement savings account (401k) with stocks as the financial instrument.

Stocks were first introduced in the 17th century and since then have experienced many financial bubbles and crashes that led to them being prohibited in countries like England.

Cryptocurrencies, to which Bitcoin belongs, may be seen as a newly emerging class of assets.

The cryptocurrency asset class is still in its infancy, having only been around for a decade. It has already experienced significant market bubbles and could see more of the same.

Source: Reddit

Remember not to put more money into an investment than you are willing to lose.

2) The value of Bitcoin fluctuates rapidly

Bitcoin is often likened to the Tulip Bubble of the 1600s and the dotcom bubble of the late 1990s.

Similarities are drawn between Bitcoin and these two historical examples of financial bubbles due to their high volatility.

Volatility is a hallmark of Bitcoin, much higher than traditional investments like gold, bonds, and commodities.

Since its inception, Bitcoin has experienced various price fluctuations, ranging from an increase of 200-2,500% and a decrease of 40% to 87%.

Significant price changes can quickly stir up your emotions and lead to rash decisions to buy and sell. And that isn’t the best way to approach Bitcoin investing.

Buying and selling should not be done blindly but instead ought to be done with careful consideration.

Purchases or sales of Bitcoin are not recommended as an impulsive decision.

3) The realm of Bitcoin is full of fraudulent activities

Bitcoin is a novel concept.

Scams are rampant, and they target people with little knowledge to steal their money.

When buying Bitcoin, be mindful of a few of the standard scamming methods:

Websites That Aren’t Authentic

An example of a scam is BitKRX, which claims to be the legitimate Korean Exchange (KRX). This fraudulent company tricked people into losing money.

Faked Airdrops

Distributing tokens to users through airdrops is becoming increasingly popular to promote a project or reward users for their contributions. And they are a real thing.

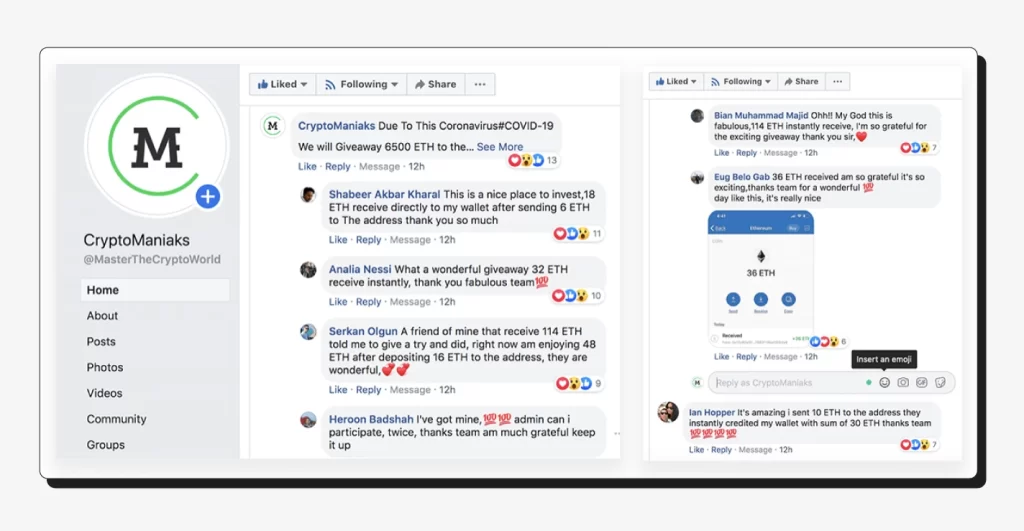

Source: Facebook. Example of how faked airdrops might look

Yet, it has come to light that people have begun creating counterfeit cryptocurrency airdrops to scam others out of money.

Ponzi Schemes

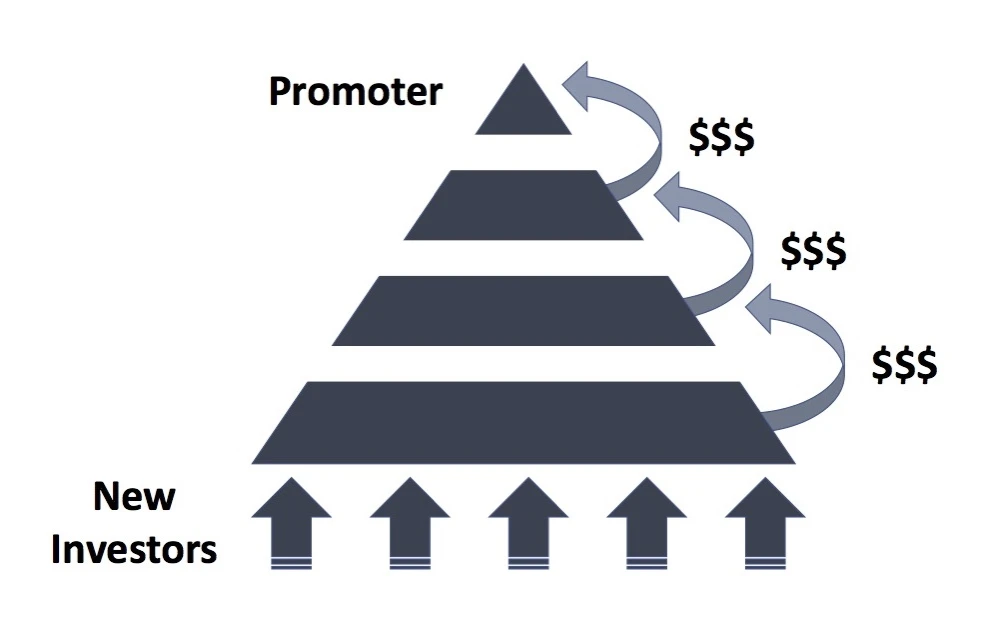

Ponzi strategies are a type of fraudulent investment that involves the payment of purported returns to existing investors from money invested by new investors.

An illustration of the Ponzi Schemes’ leading principle

In Ponzi Schemes, people are often guaranteed to get regular, steady, and high-gain revenue without any risks. Yet, the scheme crashes when organizers decide to do the exit scam.

Bitcoin investment isn’t risk-free; there is no guarantee of a 100% successful outcome.

Only those who study the proper methods to invest in Bitcoin will reap the incredible rewards.

Gain knowledge about Bitcoin and investing to be successful.

4) Mistakes with expensive consequences might occur

When investing in Bitcoin, it is possible to make costly errors as much as for any other investment class.

Investment in real estate could lead to costly repairs, picking the wrong stocks could be financially disadvantageous, and the same goes for Bitcoin.

Errors that can be costly often occur if you’re unaware of the proper ways to invest in Bitcoin.

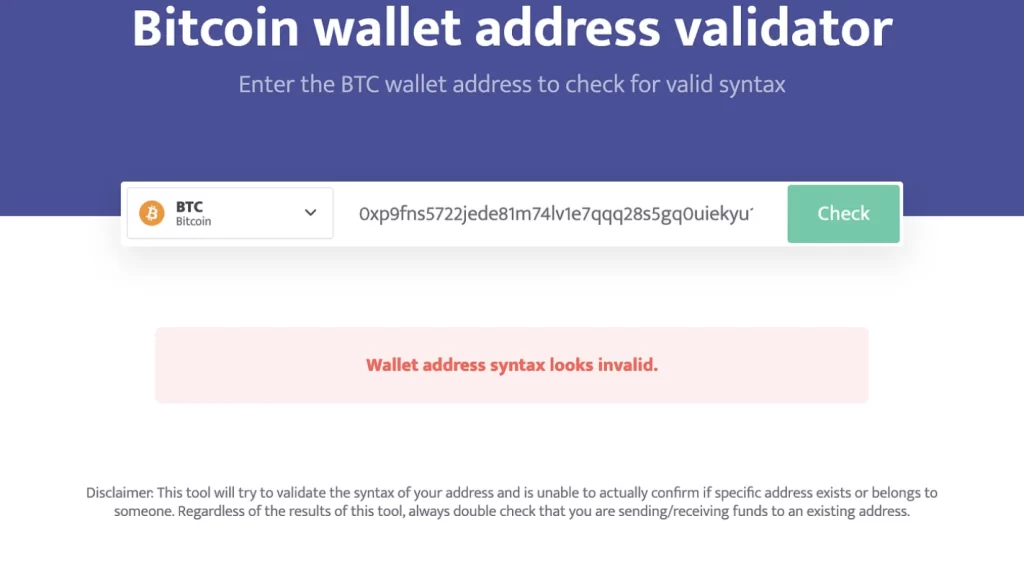

Inputting Cryptocurrency Into an Incorrect Address

Here is what a Bitcoin address appears like:

1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2

It might make you scratch your head, doesn’t it?

Verifying the address three times (or even more) before sending anything is essential.

Inflating the Price and Quickly Selling Off

Don’t believe those who claim impressive profits can be earned with “minimal or no risk at all.”

To prove the validity of a coin, they will sometimes attempt to inflate its market value.

When the cost is substantial, it will draw in other investors.

Subsequently, the initial investors who released the cryptocurrency will sell off all their tokens when the price is at its peak.

It is essential to do thorough research to avoid investing in fraudulent pump-and-dump schemes.

Malicious Software

Software created to cause harm is referred to as malware. And that’s what you have to stay away from.

Malicious software can hijack your system, rendering it inaccessible unless Bitcoin payments are made to software creators.

Malicious software can transfer any cryptocurrency you have stored on your computer to its creators.

To steer clear of these expensive issues, you can:

- Keeping a close eye on the websites visited and files downloaded.

- Using the most recent version of anti-virus software.

The primary instruction to follow when studying investment in Bitcoin: Remain educated!

Make sure that you are aware of the newest reports related to Bitcoin. Furthermore, keep up with tutorials and fine-tune your Bitcoin investment strategy regularly.

Nevertheless these issues

Investing in Bitcoin is a wise choice.

Despite the facts that have been laid out, Bitcoin could provide a once-in-a-lifetime opportunity.

I made this guide for a reason. Otherwise, why bother?

#1. Three of the Best Platforms to Put Money in Bitcoin

Let us begin with the tangible matters.

I’m going to discuss the merits and weaknesses of three of the top websites to purchase Bitcoin, as well as how they compare to one another.

Everyone has a unique opinion on which website is the best to purchase Bitcoin.

The legal system, charges, and potential income vary depending on the location.

The top three websites for investing in Bitcoin are Coinbase, eToro, and Kraken. In my opinion, at least.

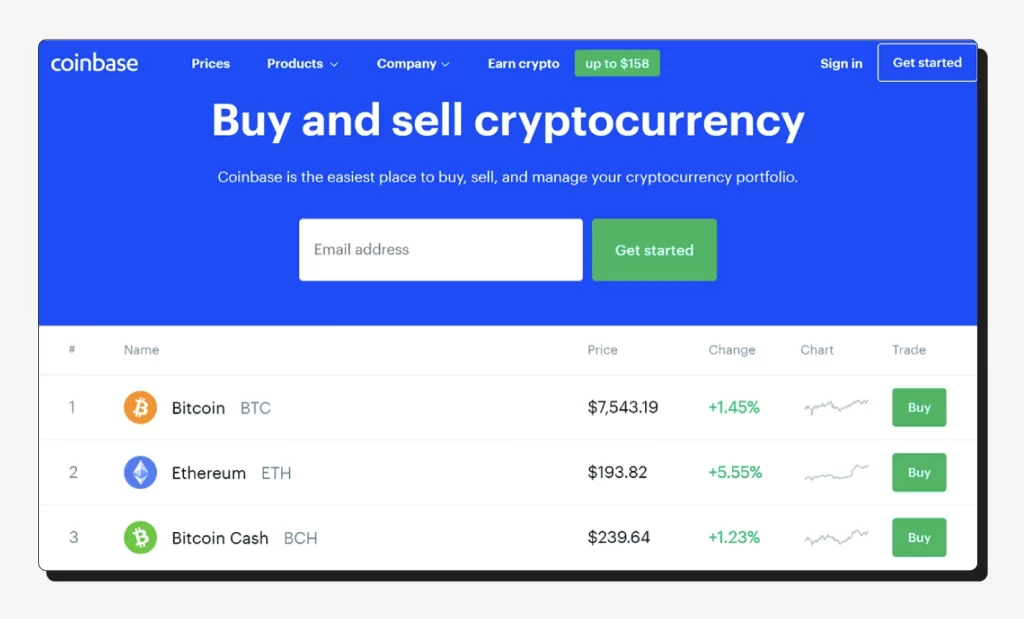

1) Coinbase

A well-known cryptocurrency platform, Coinbase offers users a place to buy, sell, and store digital currencies.

Established in 2012, they have achieved numerous successes throughout their tenure.

Coinbase also maintains an educational platform to teach users about investing in Bitcoin and other digital currencies. By watching 1-2 minute videos, users can receive cryptocurrencies in return and learn more about crypto.

Source: Coinbase

Advantages:

- Offers a great sense of security as it is insured.

- Fully compliant with regulations by all countries in which it operates.

- Have an easy-to-navigate and understand user interface.

- Supports more than 20 cryptocurrencies and is continuously expanding.

Disadvantages:

- Only the US, UK, or EU citizens can access all Coinbase features.

- The fees are average, though less expensive options may be available.

Supported countries:

Coinbase can be accessed in numerous countries, such as the U.S., U.K., Canada, Australia, and many more, except for China and Russia.

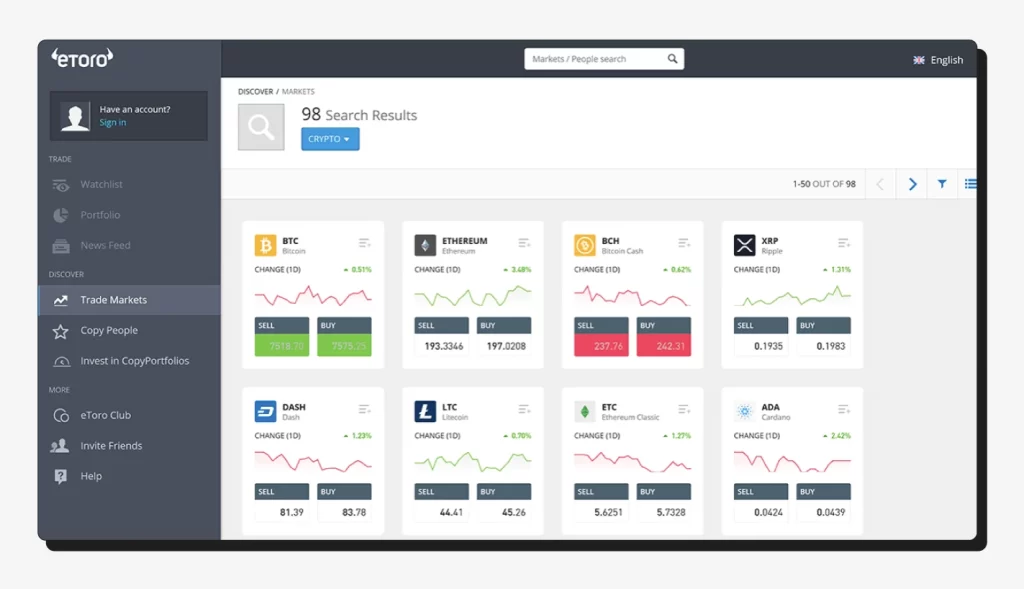

2) eToro

eToro is a trading platform that allows users to invest in a wide variety of financial instruments, from stocks and commodities to cryptocurrencies, including Bitcoin.

The platform is designed to make trading easier for novice investors. Intuitive tools and simple processes can help them gain exposure to the markets.

eToro also offers advanced features and tools for experienced traders, allowing them to access more sophisticated strategies and better manage their investments.

Source: eToro

Advantages:

- eToro is officially recognized and monitored by the countries in which it operates.

- Fees charged by the platform are minimal, and there are no costs regarding deposits.

- Offers a social trading function, allowing users to mirror the investments of the most successful traders.

Disadvantages:

- Only 17 crypto assets are available.

- Trading in altcoins carries higher fees.

Supported countries:

Residents of Canada, Israel, Japan, and Turkey cannot access the services of eToro.

Signing up and trading can be completed in minutes for those living in the United States, United Kingdom, and the European Union.

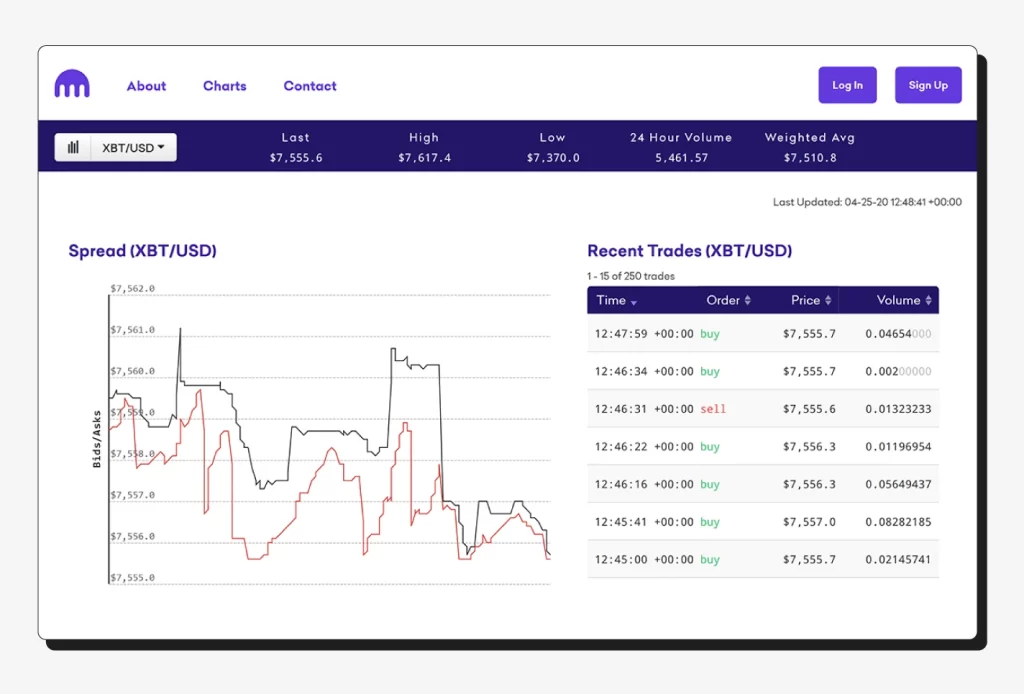

C) Kraken

In September 2013, two years of testing and development culminated in the launch of Kraken.

Over time, they have ascended to a first-rate exchange offering robust security and diverse digital currencies.

Source: kraken.com

Advantages:

- Dependable customer service around the clock.

- 30+ cryptocurrencies are available, and the overall number keeps increasing!

- Enhanced security measures.

- A sophisticated trading platform for advanced traders.

Disadvantages:

- Requires a lot of KYC to pass before starting trading.

Supported countries:

Residents of the states of Washington and New York cannot use Kraken. However, people in all other states within the US can trade on the platform.

Unfortunately, Kraken is also not an option if you come from Japan.

However, if you are from the United Kingdom or any other European Union member state, you are in luck!

Now, join me in a simple guide on how to invest in Bitcoin.

We’ll use Coinbase for that.

#2. Guide: Quick Ways to Invest in Bitcoin

No matter where on the web you go to invest in Bitcoin, the steps to do so are the same.

I picked Coinbase to provide a tutorial for investing in Bitcoin.

Coinbase has become a renowned solution for those new to the world of Bitcoin and is available globally. Furthermore, it provides good insurance coverage.

It is ideal for this tutorial, making it an excellent choice.

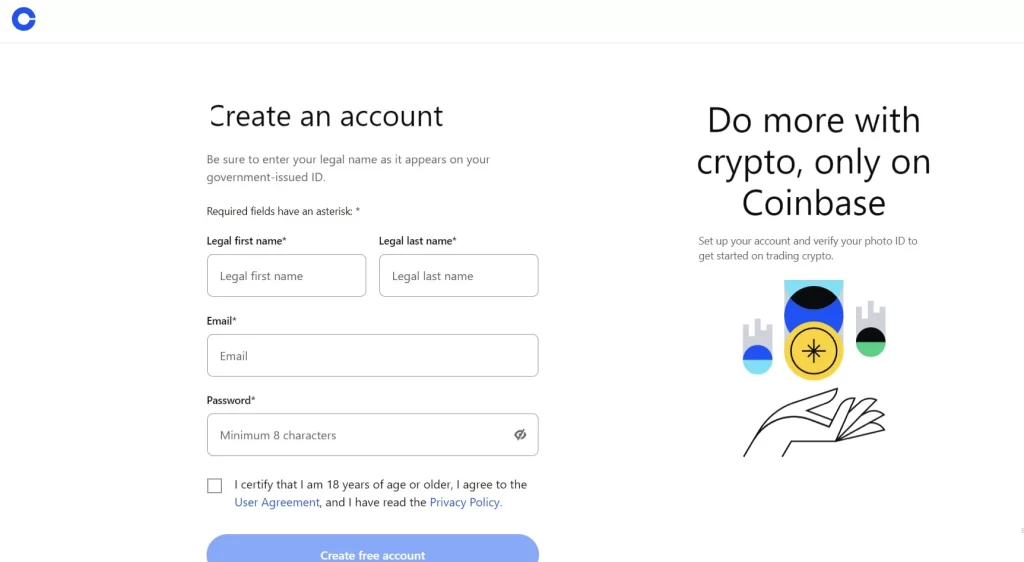

Step 1: Sign Up and Bonuses

Source: Coinbase. Coinbase sign-up procedure

- To start, click here to open a Coinbase account form. Also, when you deposit a minimum of $/€/£100, you can get an extra $10 thanks to a special offer.

- At the bottom, fill in the necessary information. Create a secure password, review your details, and press “Create a free account.”

- Check your email for the link to validate your address.

- Enter your phone number and input the code from the SMS you received to complete the process.

- On the next page, input your personal information.

It is essential to keep in mind the following:

The country of residence you provide an essential piece of information because:

- The payment methods you can use in the future will be determined by the country of residence you have entered.

- You will need to provide two forms of photo identification when using Coinbase. The same country must issue these as the one you have selected for your residence.

Step 2: Verify Yourself

Financial service provider Coinbase must identify its customers due to its regulated status.

They must obtain some of your private data to fulfill this task. Here is how the process goes:

- To commence your identity verification on Coinbase, log in to your account, click “Dashboard,” and then “Verify your identity.”

- Select one of the following documents to submit: a driver’s license, passport, ID card, or even a student card (which we had tried, and it worked). Ensure that all corners of your ID are visible in the picture.

- Your webcam will likely prompt you for permission to activate to take a selfie of you to compare to your ID card.

- The identity verification process should be completed within two to ten minutes after submission.

Here are some helpful links:

- If you need help verifying your ID, you can look at this help page.

- If your issues weren’t resolved, go to this web page.

Step 3: How to Add Payment Method?

Before investing in Bitcoin, one must add a payment method.

Various means of depositing funds exist, each with benefits and drawbacks.

Generally, bank and wire transfers are inexpensive but take time to process, whereas card payments are usually done instantly but tend to be costlier, typically around 4%.

You should use your debit/credit card to make your first purchase to avoid waiting an extended period before acting.

When you buy for at least $100, you get a $10 reward that will cover the purchase cost.

This option is available only if you utilize our unique signup link.

These are the instructions that will help to add your card as a payment method:

- After logging in to Coinbase, go to the dashboard and choose “Add Payment Method.”

- Choose “Credit Card/Debit Card.”

- Submit the information and click “Add Payment Method.”

Let’s get to the exciting part: I will demonstrate how to start investing in Bitcoin.

Consider that the gif illustrates the process in a way that is different from the explanation given.

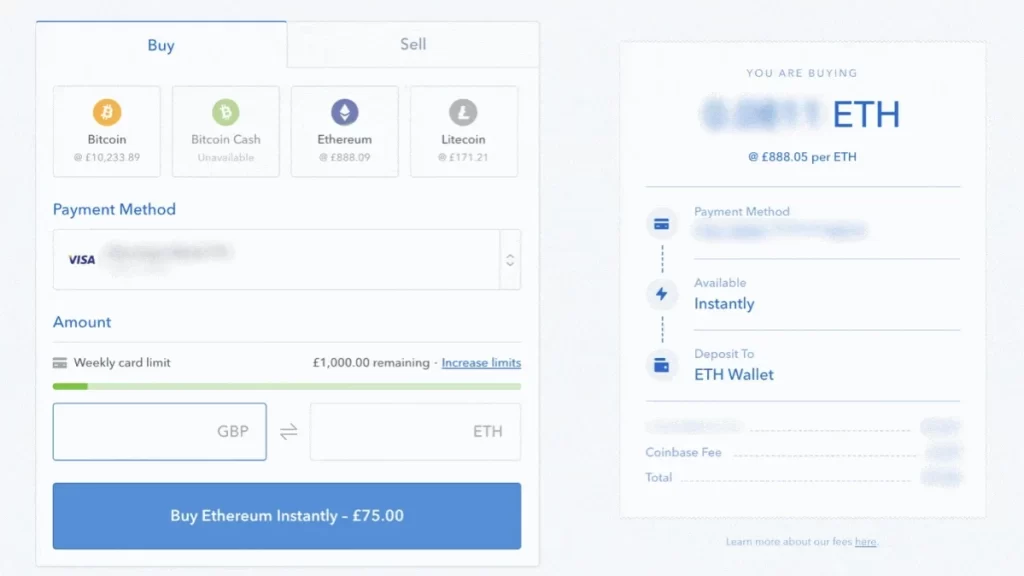

Step 4: Purchasing Bitcoin

After you have done the prior steps, acquiring your initial Bitcoin will be simple.

Similar processes to buy ETH and BTC

- At the top of the page, go to “Buy/Sell”.

- Select Bitcoin as the asset you are acquiring.

- Choose your card as the payment method.

- Pick the quantity of fiat you are exchanging. Don’t forget to acquire more than $/€/£100 for your $10 bonus.

- Press “Buy Bitcoin Instantly.”

After completing the purchase, you’ll find your crypto on your account’s balance.

You’ve done it!

#3. Transfer Your Cryptocurrency to a Wallet You Manage

A key point is reached as you progress in your journey of understanding Bitcoin investing.

You’re ready to know about transferring the Bitcoin you recently obtained to an account you managed.

It’s a widely held belief in the Bitcoin world that if you don’t own the keys, you don’t own the Bitcoin.

Not Your Keys, Not Your Bits: True Or False?

This concept is straightforward: the individual must have control of the private key to access their account.

If the coins in your Bitcoin wallet do not belong to you, they are not yours.

The crypto community is so attached to this phrase because of occurrences such as the Mt. Gox incident.

At the very beginning, Mt. Gox was the biggest crypto exchange. Unfortunately, bankruptcy was declared in 2014, and very few could recover their Bitcoin.

In 2018, the founder of a Canadian exchange called Quadriga made a trip to India and, sadly, died.

He was the owner of $190 million worth of Bitcoin and cryptocurrency. His death resulted in the loss of the entire amount as he didn’t give out the personal keys of the wallets to anyone.

The Present-day Differs From What It Used to Be

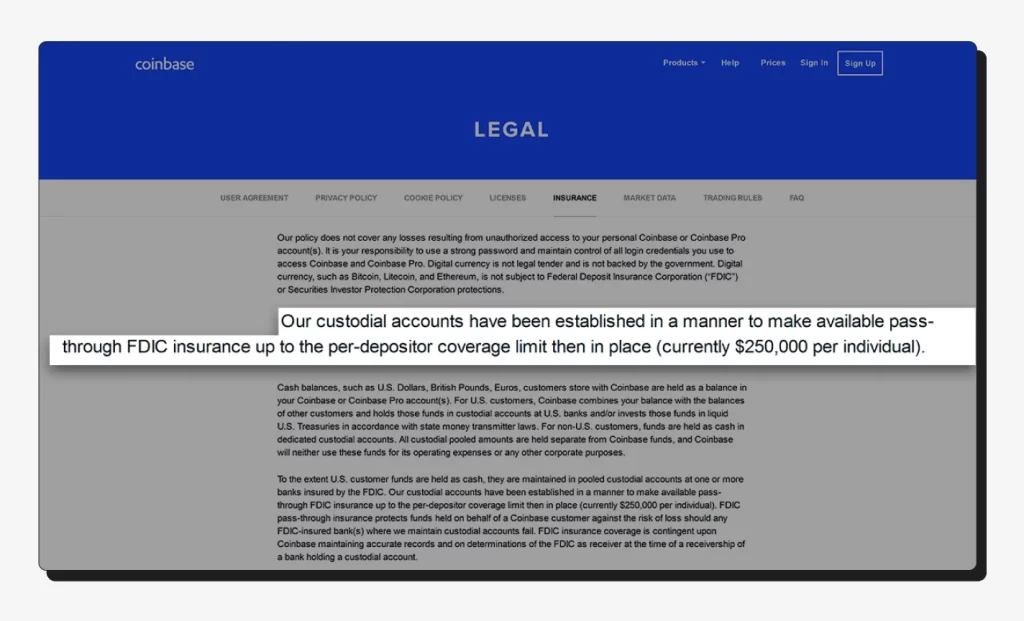

Nowadays, if you use a platform like Coinbase, you can take advantage of their FDIC insurance, which will protect your deposits.

Source: Coinbase

In addition to its superior security measures, Coinbase has other very stringent protocols, including:

- Multi-signature wallets. These wallets keep your Bitcoin and require signatures from several authoritative sources to open them.

- Offline wallets. Coinbase stores Bitcoin away from the internet to prevent any security breaches.

- Know Your Customer (KYC) authentication. Coinbase necessitates you to validate yourself. If you forget your password or can’t use two-factor authentication, you can go through a confirmation process to retrieve access.

If you accept the responsibility, I advise you to shift your Bitcoin to a wallet you own instead of leaving it on one of the highly secured cryptocurrency exchanges.

You can transition without any worries if you are confident in your technical abilities.

It is now commonplace to keep some of one’s funds in a secure and insured exchange.

If the cost of your Bitcoin reaches a point where you would like to dispose of it, then it will be a straightforward procedure.

The Most Secure Wallets to Keep Your Cryptocurrency

If you choose to keep your Bitcoin in a wallet you control, the next step is to select a wallet before investing in Bitcoin.

One should look into these top-notch Bitcoin wallets if considering one.

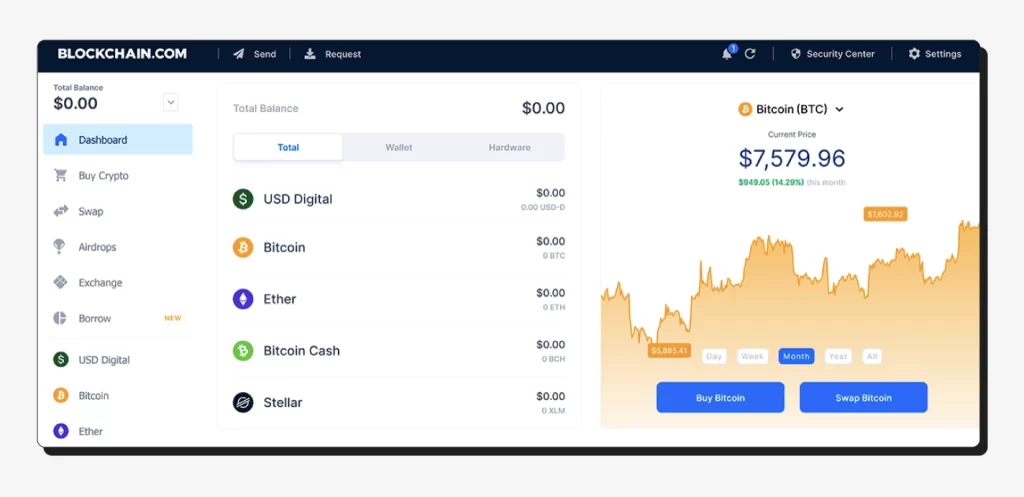

Blockchain.com (free)

Offering one of the most dependable digital wallets for Android and iOS, their product is a must-have.

Source: blockchain.com

Advantages:

- Quick and straightforward to configure.

- High level of safety.

- QR codes enable you to transfer and obtain crypto quickly and effortlessly.

Disadvantages::

- It is simpler for cyber criminals to access your crypto stored on the internet. Consequently, your funds are at greater risk.

Ledger (paid)

At present, Ledger is among the best hardware wallets available worldwide.

This small device can be held in the hand, storing more than 70 cryptocurrencies.

Source: ledger.com

Advantages:

- The highest level of security.

- Your crypto is held in an offline storage.

- It’s more secure than Trezor wallets (the leading competitor, hacked recently).

Disadvantages:

- It is more complex than a digital wallet or exchange.

- The cost is between $60 and $120, depending on the model you pick.

Moving Your Cryptocurrency Into Tour Wallet

When you select your wallet, now is the moment to transfer your cryptocurrency for the first time.

No matter the objective of the exchange, the procedure remains comparable.

Here is how it goes:

- Create a new address on the target wallet or copy an existing one.

- Begin the transfer from the trading platform (find the “withdrawal” section).

- Place the target address and enter the amount for the transfer.

- Carefully double-check the information; you can only retrieve the coins if sent to the correct address.

- Click “Send”.

Before I end the transfer, I double-check that the initial two symbols and the concluding three characters are accurate.

Source: minerstat.com

Also, you can use validation services across the web to check the Bitcoin wallet address is valid.

#4. Get to Know These Security Tips

You still have more to learn when it comes to investing in Bitcoin.

The crypto realm remains a hazardous environment.

Despite being a relatively new form of financial technology, Bitcoin creators continuously work to enhance its features.

Therefore, is there still time to jump on the bandwagon and invest? The answer is a resounding yes.

It is vital to recognize errors and fix the security breaches that result from them to keep progressing.

Here at *INSERT WEBSITE’S NAME*, the security of your funds is of utmost importance to us.

We know the repercussions of having money stolen or lost due to hacking, scams, or errors, which is why we take this seriously.

We can gain wisdom by considering our own experiences!

1) Keep Your Private Keys Private

Nobody would share their private key; however, it is worth mentioning.

It can be challenging to distinguish between private and public keys.

The difference between private and public keys

It should be noted, however, that private and public keys have distinct applications.

Similar to an account number from a bank, your public key is required to receive money from others. Providing it to individuals is necessary for them to be able to transfer funds to you.

It is essential that only you be aware of your private key, in the same way that you would keep a login password secret. This will enable you to protect your account and make withdrawals.

If you inadvertently copy/paste your private key when you should have revealed your public key, you will be putting your entire wallet at risk.

2) Activate Two-Factor Authentication

Two-factor authentication is represented by the acronym 2FA.

This means there must be two independent methods of authenticating one’s access to an account or wallet.

Your password is the first line of defense. To add an extra layer of security, a two-factor authentication (2FA) app like Authy or Google Authenticator can be used.

A new unique code composed of 6 digits is created every 10 seconds.

To access your account, enter the six-number code and your password.

Making your account much less vulnerable to breaking is essential nowadays, and 2FA is a pretty important part of modern security.

3) Be Aware of Ponzi Schemes

Not acquiring all the necessary knowledge to invest in Bitcoin properly can leave one vulnerable to Ponzi Schemes.

The importance of the Russian proverb “don’t trust, verify” cannot be overstated; with the emergence of Bitcoin and other new asset classes, many new scammers have arrived.

If someone offers you an investment plan, examining all the claims they make is suggested.

Confirm the identity of the people in charge, how the company is managed, and what the payment process is.

Three signs can help to identify a Ponzi Scheme. They are:

- Astonishing profits on your capital that appear implausible.

- No risk claims. This is always a significant warning sign. There are always at least some potential risks with anything.

- A reward system if you spread the word to your acquaintances and loved ones.

4) Secure Connection Only

Establish a secure connection when dealing with Bitcoin, as not doing so may make you vulnerable.

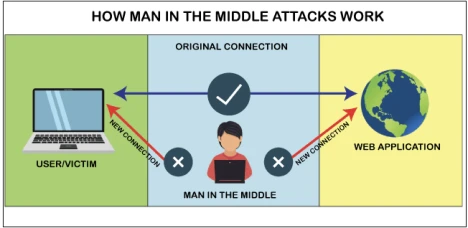

For example, let’s talk about a “man-in-the-middle” attack.

Source: javatpoint.com

With this attack, the perpetrator can intercept the data you send or receive, including your private keys and passwords.

Therefore, ensuring that all connections are secure at all times is extremely important.

5) Create a New Email Address For Crypto

The email address associated with your exchange accounts, such as your Coinbase account, is the one you utilize.

Getting newsletters and verifications is done through this method.

Recovering your account requires you to have your email address on hand if you ever need access.

If a cybercriminal were to take over your email, they would be able to access your accounts.

Protecting your email account from hackers can be easier by having a different email address for your Bitcoin accounts.

6) Utilize Secure Passwords

It is estimated that more than half a billion passwords kept in private records have been revealed due to data security breaches.

Databases containing all those passwords are now accessible to hackers.

You can go here to check if your password is part of the breach.

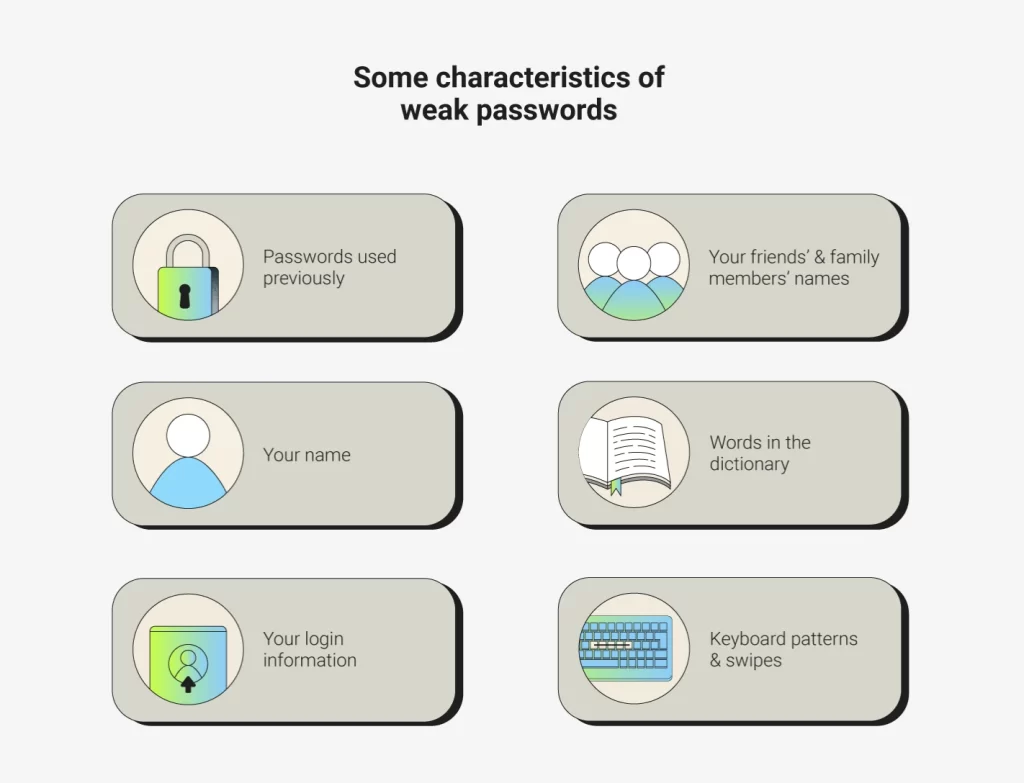

When investing in Bitcoin, it is essential to avoid passwords that can be easily guessed from social media, such as those based on birth date or favorite pet.

Source: trendhunter.com

Thus, it is not advisable to create your passwords on your own.

Consider a password generator and manager such as LastPass for optimal security.

G) Ensure to Backup and Store Safely All Keys, 2FA, etc.

In the event of data loss or a cyber attack, there are three strategies one can use to retrieve their data:

- Make sure to have copies

- Make sure to have copies

- Make sure to have copies

I’m not repeating myself; I mean it.

Envision having all your gold stored in a secure safe, recording the combination to unlock it, and then not being able to recall it finding the paper you wrote it on.

Being deprived of one’s Bitcoins is far more disadvantageous than that.

A locksmith could be of assistance in unlocking your safe.

If you cannot recall your keys and do not have a backup…

The locksmith won’t be able to assist you.

It is essential to create copies of your keys, your two-factor authentication codes, and any other items you use to gain access to your accounts. f

Preserve the files in two or three different locations to ensure their safety.

One copy should be stored in a fireproof space, a second in an outside safe spot, and the third in a different secure site.

Review Security Guidelines From Time to Time

It is up to you how to manage your financial resources.

Take the time to review the security tips again, at least sometimes, for any updates.

You will be grateful to yourself in the future for taking this precaution before investing in Bitcoin.

#5. Utilize Appropriate Instruments to Monitor Progress

Adeptness in investing in Bitcoin necessitates acquiring proficiency in utilizing the apt instruments.

- To keep track of stocks, you need to invest in proper tools.

- To store the gold, you need to invest in proper tools.

- Investing in real estate requires buying some physical tools (e.g., for home improvement).

These are the essential tools to equip yourself with when investing in Bitcoin.

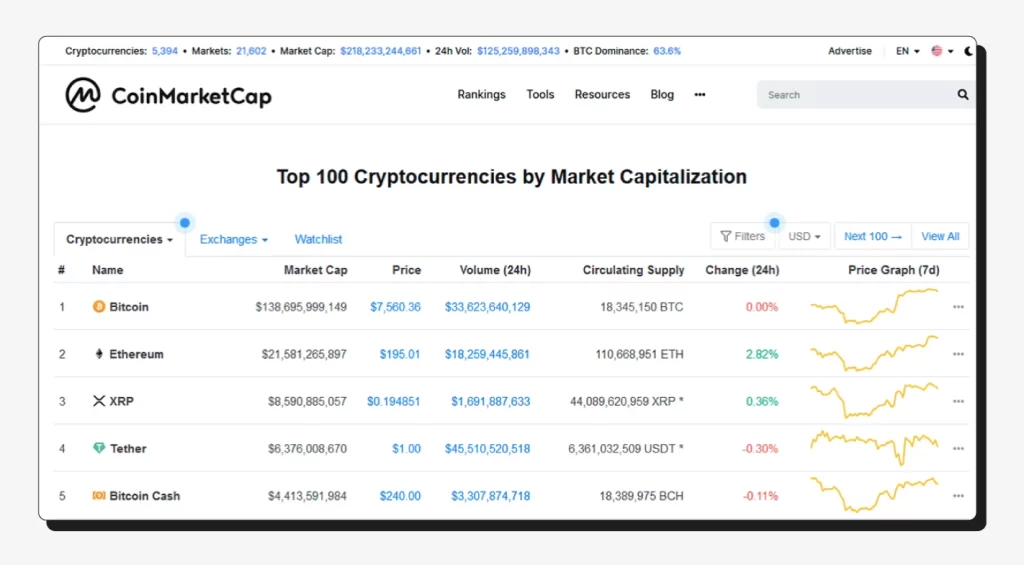

1) Coinmarketcap

Source: coinmarketcap.com

Sooner or later, all those getting started investing in Bitcoin will come across this website.

Coinmarketcap is the premier source of cryptocurrency prices due to its comprehensive database and user-friendly interface.

Cryptocurrency numbers can be easily understood by using this resource.

Coinmarketcap is the ideal source of information to discover the value of Bitcoin or any other digital currency.

Head to Coinmarketcap if you need to comprehend the amount of cryptocurrency in circulation or a platform where it is being sold.

This is a handy resource, and investing the time to become familiar with it is worth it.

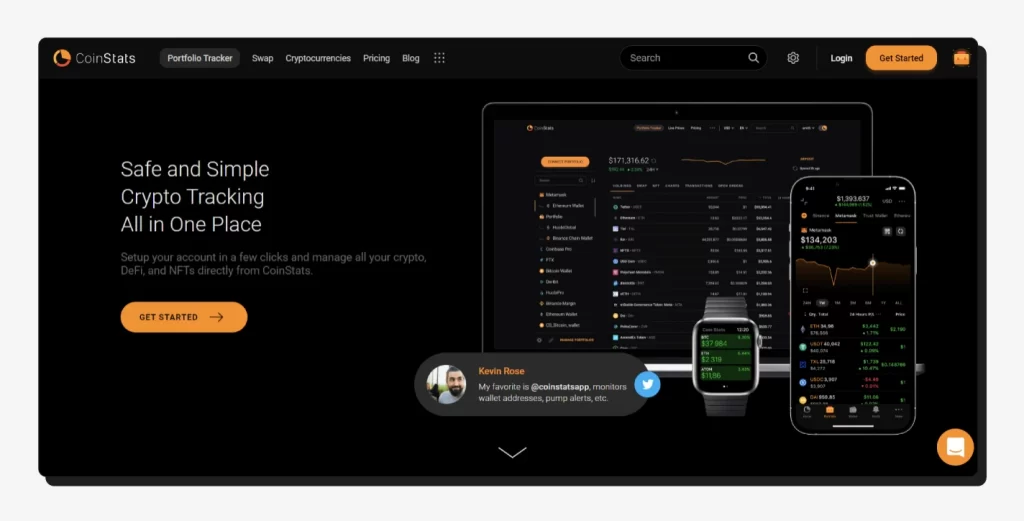

2) CoinStats: Monitor Your Portfolio

Source: coinstats.app

CoinStats provides access to over 400 crypto platforms, including Binance and Coinbase.

This platform is a hub for looking after your digital currency and decentralized finance (DeFi) resources.

CoinStats takes security seriously, utilizing encryption that is of military quality.

CoinStats keeps tabs on over 500 million dealings.

The platform allows one to monitor, evaluate, and gain insights into Bitcoin and over 8,000 other cryptos.

The company controls over $100b in investments.

It is possible to control both DeFi and crypto assets here.

Crypto assets can yield a maximum of 20% APY per annum.

Establishing your account is easy, allowing you to use cryptocurrencies, decentralized finance, and non-fungible tokens quickly.

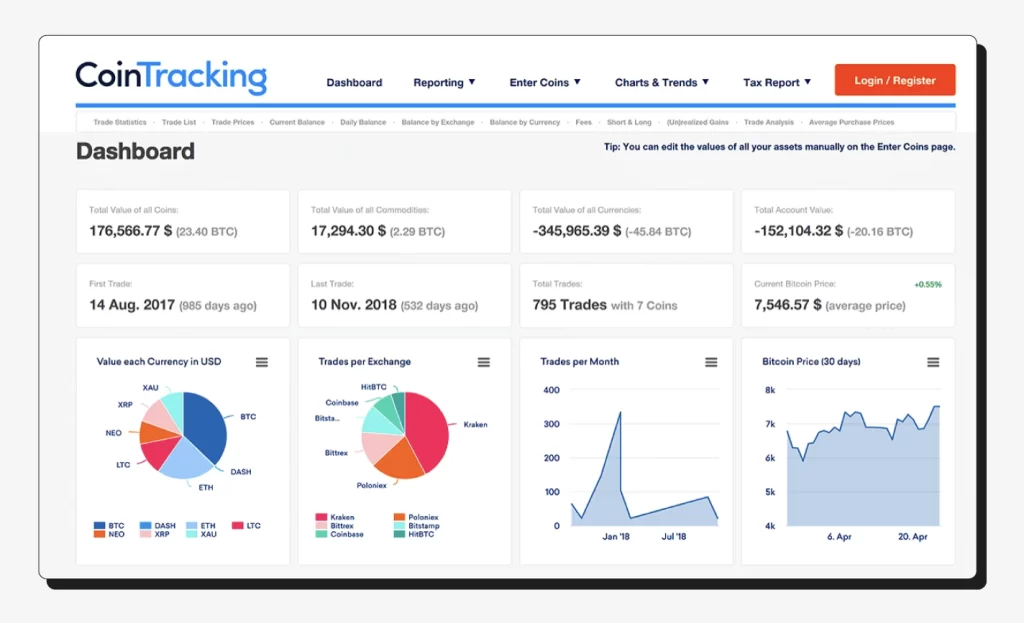

3) CoinTracking: Crypto Tax Reports Production Service

Source: cointracking.info

Worldwide, including the United States, it is necessary to declare any revenue acquired from digital currencies.

For the 2019 tax year, all U.S. citizens who file taxes must answer the question: “Did you purchase, sell, or hold any cryptocurrencies in 2019?”

It is wise to be honest when dealing with the IRS, as they have entered into agreements with nine agencies focusing on cryptocurrency forensics. These agencies can determine who is investing in cryptocurrency and whether or not they are reporting it.

If you want to invest in Bitcoin, consider using a tool such as CoinTracking.

Investing in Bitcoin could be made easier with this type of tool.

CoinTracking can help avoid the hassle of computing gains and losses, thereby preventing much aggravation.

Simply input the data into the program and let it deal with calculations.

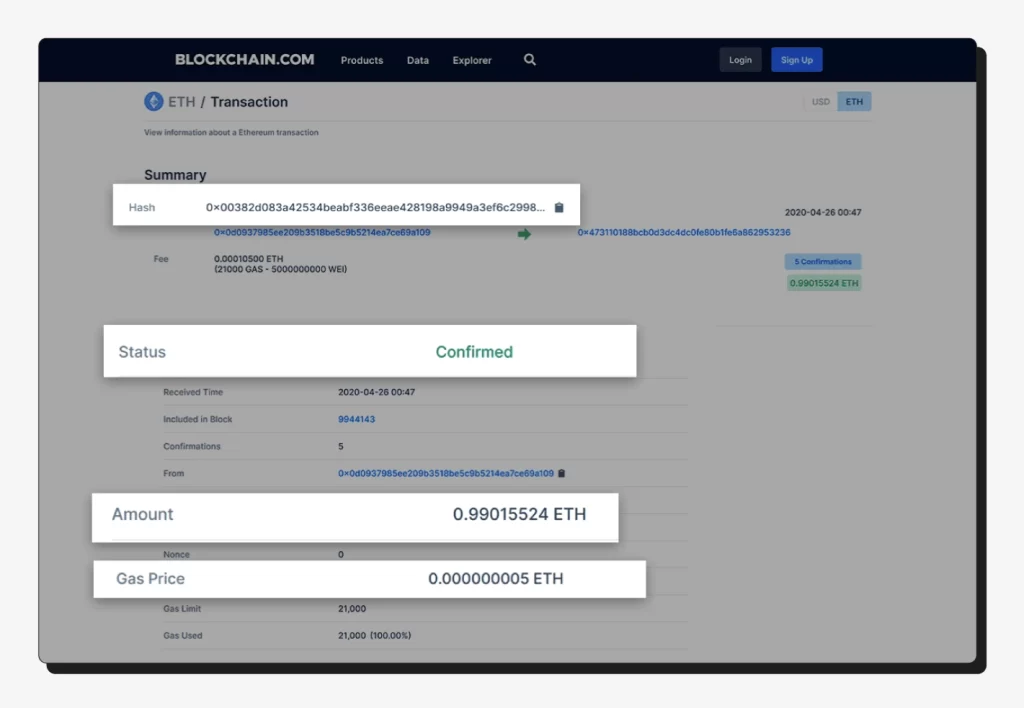

4) Blockchain Explorer Tools

It is essential to monitor your cryptocurrency deals.

You might have sent some funds from one pocket to another.

The transaction may take 10 minutes, though it could take up to two hours or longer.

You can track your transactions by utilizing an explorer, e.g., blockchain.com.

For instance, if your Ethereum transaction processing is taking too long, it is possible to determine if the transaction did not utilize the correct amount of gas.

Source: blockchain.com

When doing taxes, blockchain explorers can be employed to identify all of your transactions.

To view your prior transactions, enter your public address in Explorer.

The address will reveal the date, time, and quantity of all transactions, whether deposits or withdrawals.

Having Good Tools = Making Good Trades

Your repertoire of skills can be expanded with many additional tools.

Ensure you investigate the list of helpful crypto tools for the best experience.

Not all of them need to be used, but one or more may be just what you need.

It’s like constructing a bookshelf with a flathead screwdriver.

[Bonus Info] What is the Appropriate Amount to Invest in Bitcoin?

“For those seeking a daring, risk-taking venture, a potential option could be to set aside 10% [of their savings] to invest in either Bitcoin or Ethereum.”

Mark Cuban, a billionaire investor and a star of the “Shark Tank” show, uttered that famous quote. The source of the quote can be found on the website of CNBC.

However, he follows this statement: “It is essential to act as if your funds have already been lost if you do it.”

Cuban has brought up a great idea – Bitcoin is an unpredictable investment.

Your hard-earned cash could be lost due to the sudden crash of prices, being taken advantage of via scams, or getting hacked due to an error you made.

Hence, it is essential to commit a sum that:

- It can generate enough income for you.

- Doesn’t cause severe emotional distress if you fail to gain a profit.

Depositing the minimum amount of $5 in certain exchanges won’t cause deep sorrow if it goes down, but won’t bring much of a reward if it increases in value.

If you become distressed when the market fluctuates and sell at a loss, you must know that this attitude is unsuitable for investing in Bitcoin.

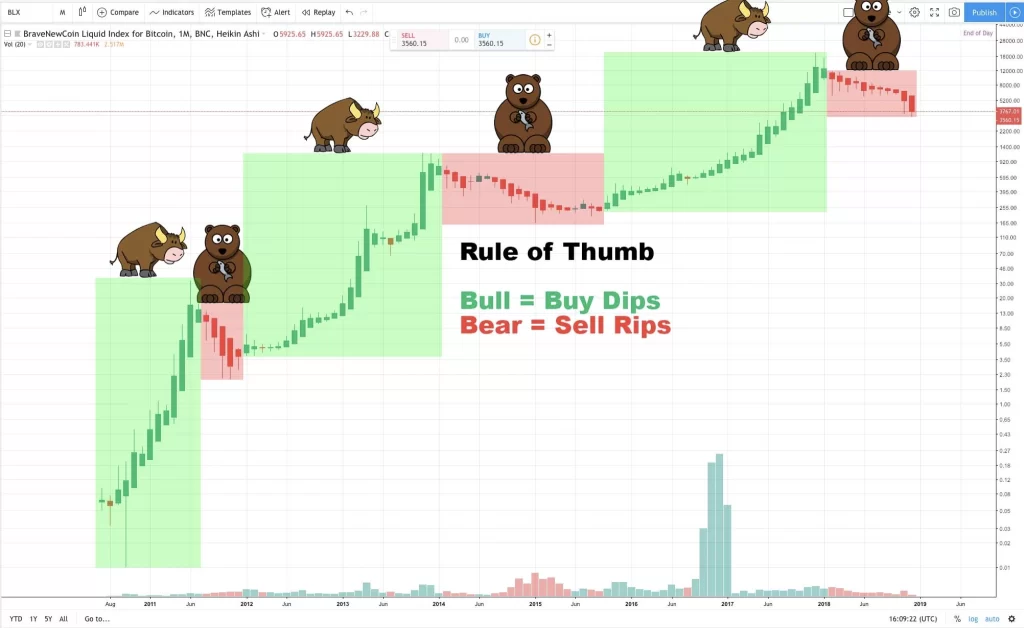

[Bonus Info] Opt for Your Timing

Success in Bitcoin investing requires careful consideration of the timing of each investment. Timing is paramount.

Reiteration is necessary to ensure my point is understood.

If you acquire the knowledge of investing in Bitcoin when the market is at its ups, your enthusiasm for the modern technology it holds could result in an immediate purchase.

It would have been prudent to study all the available information on Bitcoin to understand it better before continuing. With that knowledge, you ought to pose the question:

“Are the market conditions suitable to purchase?”

However, it is essential to be aware that the timing of certain activities is difficult to predict.

Not knowing when a bull phase might be replaced with a bear phase is fine.

The cycle will only reach its apex or nadir once it has finished.

Bull/bear phases change

Rather than attempting to locate the ideal moment to buy or sell, ensure you are not entering the market following a significant rise or exiting after a substantial decrease.

When a coin has experienced some days of consistent gains of 5% or more without any fluctuation, it is in a solid upward trend that is likely to correct at some point.

It is recommended that you abstain from investing unless you have sound and valid justification to assume that the cost of Bitcoin will increase.

When a coin has been steadily losing value by 5% or more for days without any noticeable increases, it’s seen to be in a downward trend.

Take your time selling since the price could rebound.

So, is it already too late to put money into Bitcoin? Not at all, if you heed our advice!

[Bonus Info] Placing Money in Various Cryptocurrencies

“One way to protect yourself against risk in investments is to diversify, which involves spreading investments across different types of assets.

This exercise is intended to diminish the instability of your portfolio in the long run.”

It’s the best way to illustrate the advantages of investing in other digital currencies besides Bitcoin.

By signing up with Coinbase, you can access the market of well-known cryptocurrencies.

Before investing, research and identify an approach that aligns with your investment objectives and strategy.

Once you have selected a cryptocurrency you feel comfortable with, you can check if it is available on Coinbase.

Should you still need to do so, consider trying Binance as a viable option.

Binance is a primary crypto-to-cryptoto exchange provider with an expansive selection of over 150 digital currencies.

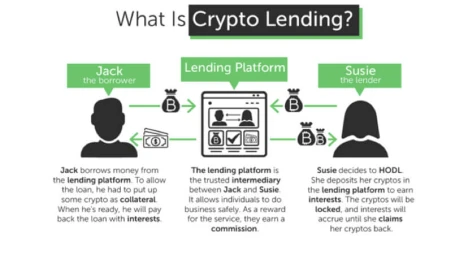

[Bonus Info] Gain Interest Through Possessing Bitcoin

Once you have established the necessary infrastructure for your Bitcoin activity, you may be interested in learning how to make a return from your Bitcoin.

The Bitcoin community is highly supportive of individuals holding their Bitcoins.

There are intervals of every 3-4 years where considerable spikes occur.

Yet, keeping your Bitcoin without taking advantage you might obtain from it looks like a waste.

HODL vs. LEND. Crypto lending explained

The top-ranked Bitcoin lending platforms enable users to keep their crypto assets safely while obtaining interest from it, much like a savings account.

The annual interest you get is contingent on which crypto you opt to store (commonly Bitcoin, Ethereum, or USDT).

Interest can be paid out daily, weekly, or monthly. Furthermore, you might withdraw whenever desired. It is essential to remember this when investing in Bitcoin.

Take a stab at it!

I expect you to find pleasure in perusing my complete guide on investing in Bitcoin.

Please let us know your thoughts and ask your questions.